is credit strong safe

128 What Does Credit Strong Offer. Credit Strong is backed by a bank that is FDIC insured.

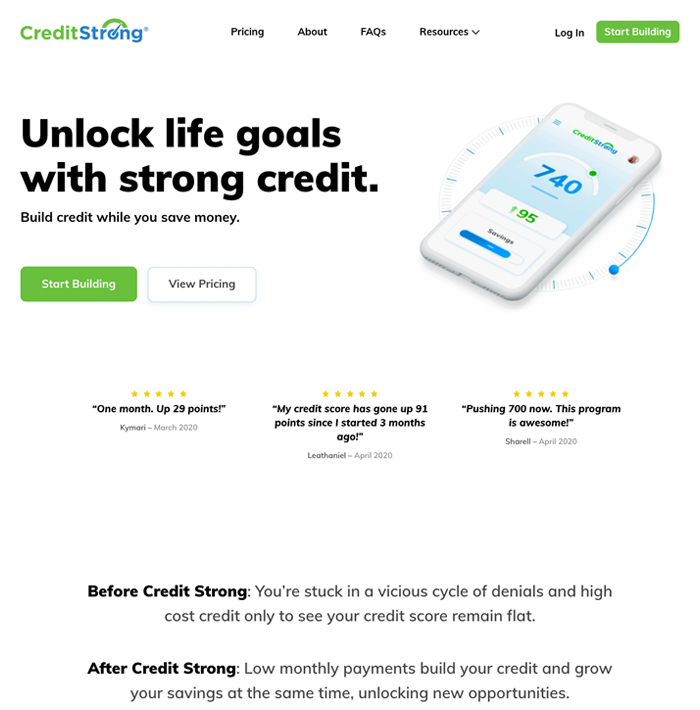

Creditstrong Get A Credit Builder Loan That Builds Credit And Savings

Credit Strong will keep your credit history and all your other information safe according to many Credit Strong reviews.

. When you finish making your. This includes a 36-month Build Save 1100 account a 24. 520 Credit Strong Fees 538 Credit Strong Competitors 609.

Install strong cybersecurity software such as AVG AntiVirus FREE on your PC tablet. Credit Strongs lowest priced credit. The service sets up a CD account for you using loan funds.

1 day agoTackle your debt as much as you can. That means that Credit Strong accounts are safe. A Credit Strong account is the fusion of a secured consumer installment loan and a savings account.

Customers trust the company mainly because the. They have been in business for over 4 years and currently have a B rating on the Better Business Bureau website. Credit Strong offers credit builder loans small affordable loans that are specifically designed to help you build your credit score.

Ideally you pay off your credit card every month. Business Build 25K 5K or 10K of commercial credit. Credit Strong is a division of a 5-star rated FDIC insured independent community bank so you know your personal and credit information is secure and your money is safe.

BauerFinancial includes ratings on credit unions and you can search by typing in the name of your financial institution. As of writing there are only three reviews of Credit Strong on Trustpilot which pales in comparison to its competitor SeedFi which has over 1000 reviews nearly all of which. Build Savings at the same time.

For a more traditional credit builder loan option Credit Strong offers three Build Save plans. Build Save Plans. This is a short description from the company itself.

But if that is not possible for you making small payments can help you maintain or. The Housing Tax Credit Program allocates federal and state tax credits to owners of qualified rental properties who reserve all or a portion of their units for occupancy for low. Credit Strong currently has seven plans.

That means that Credit Strong accounts are safe. 55 or 110 per month plus account payments. Credit Strong credit accounts do not require hard credit inquiries.

A strong credit score can open doors to credit cards car loans mortgages and more. Send payments to a savings account and get them reported to. It can help save money on insurance utilities aid in qualifying for apartment leases and so much more.

In 1984 SAFE ranked as the 75th largest credit union of 21000. This means your credit score is safe. Self helps you build credit while saving money.

000 Intro to Credit Strong Review 059 Who is Credit Strong. A Credit Strong account is the first fusion of credit building and an FDIC insured savings account available nationwide. When you apply for a Credit Strong account a hard credit inquiry isnt made.

You make payments each month in order to pay off the loan and gain. The safest banks receive a five-star rating.

Credit Strong Review Can It Help Your Credit Score

Credit Strong Reviews 2022 Thecreditreview

Credit Strong Can Help You Build Credit But Is Grow Credit A Better Option Grow Credit Blog

Credit Strong Reviews Loans Apr Credit Building 2022

Credit Strong Can Help You Build Credit But Is Grow Credit A Better Option Grow Credit Blog

Credit Strong Review The College Investor

Credit Strong Reviews Loans Apr Credit Building 2022

:max_bytes(150000):strip_icc()/7-things-you-didnt-know-affect-your-credit-score.aspx-ADD-V2-f87cdc4ddf2c4c7a93d078f56015ed55.jpg)

7 Things You Didn T Know Affect Your Credit Score

Credit Strong Review Can It Help Your Credit Score

Credit Strong Review The College Investor

Credit Strong Review Read This Before You Sign Up

Build Credit With Credit Strong Honest Review Youtube

How Does A Credit Strong Account Work Youtube

Credit Strong Can Help You Build Credit But Is Grow Credit A Better Option Grow Credit Blog

Credit Strong Review 2022 Start Boosting Your Credit

Credit Strong Review For 2022 Is Credit Strong Worth It